Live Cryptocurrency Market Updates,

Prices, and Analysis | BitXEdge

BitXEdge provides in-depth analysis, current prices, and live market updates for the cryptocurrency market. Utilize precise charts, trading volume, and market capitalization information to track the prices of Bitcoin, Ethereum, and other major altcoins. Our cryptocurrency market dashboard assists traders in making informed decisions through the latest trends, technical analysis, and sentiment indicators. BitXEdge provides reliable information, 24/7 market news, and tools tailored for successful trading and research, regardless of your level of experience in cryptocurrency trading or analyzing market signals.

Technical Analysis

Get fast and visual technical analysis ratings on any crypto symbol!

Technical Ratings section measures overall market action as determined by technical indicators in the Short, Intermediate and Long term. Powered by advanced indicators and analysis tools, it’s perfect for traders who want real-time aggregated market news, rankings, prices and value analysis.You can now know which cryptocurrency to invest in—definitely a must-have on your list!HELPS YOU MAKE SMARTER, DATA-DRIVEN TRADING CHOICESGet real-time

Bullish (buy),

Neutral (hold) or

Bearish (sell)

signals for the cryptocurrencies you’re interested in — so you know when exactly is a good time to buy

Buy – Strong technical momentum and positive trend signals.

Neutral — Mixed signals; market may go sideways/consolidate.

Sell — Poor technicals; trend is ready to move lower or has hit an exit signal.

Crypto Market Data Explode Your Portfolio Today

Welcome to BitXEdge Live Crypto Market — your live dashboard for monitoring cryptocurrency prices, charts, and volume at exchanges all over the world.

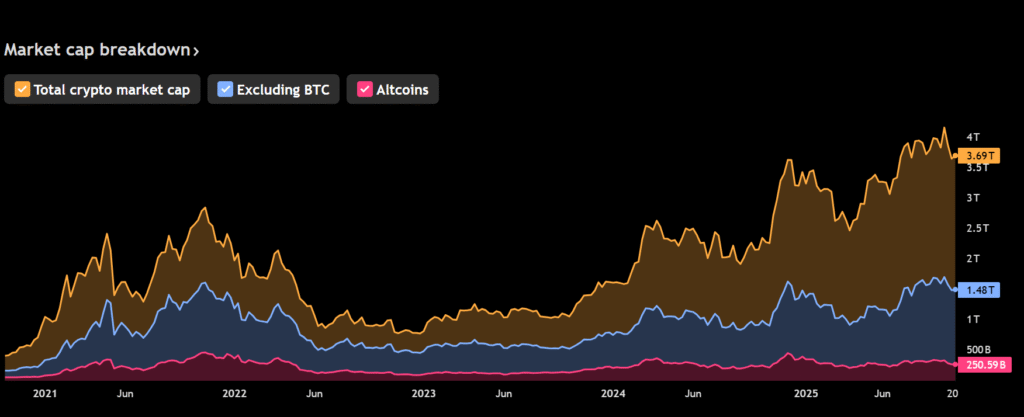

Track Bitcoin, Ethereum, and popular altcoins with real-time market data, coin performance metrics, and crypto heatmaps created for traders and investors. Get ahead of the game with current crypto market analysis and commentary to make better trading choices.

Cryptocurrency Heatmap

Why traders depend on it, what it is, and how to use it

Real-time market capitalisation and volume insights for Bitcoin, Ethereum, and XRP are provided by the Cryptocurrency Heatmap.Discover how market capitalisation, price momentum, and trading volume for Bitcoin, Ethereum, XRP, and thousands of other altcoins are displayed in a crypto heatmap. Actionable strategies and best practices are useful for traders, portfolio managers, and content producers.

A crypto heatmap presents a colorful overview of the whole crypto market fast. You see a visual representation combining everything—market cap, charge changes, purchasing and rather than having to deal with endless lists or dull spreadsheets. Selling volume—right before your eyes. It’s the kind of device that our purchasers, analysts, or builders will note which funds are ablaze, which are losing momentum, and where all the activity or fluctuation is. Particularly because they manage thousands of tokens without upsetting you, heatmaps are now incorporated into somewhat a lot of different serious crypto terminal or trading platform.

What do you really see on a crypto heatmap?

Generally, the larger the tile, the higher the market value of the coin. Therefore, Bitcoin and Ethereum are exceptions in the same time frame—they are the behemoths controlling the market.

Price exchange (24 hours a day, seven days a week): Colors speak here. Vibrant green approaches screams losses from a coin’s soaring, deep purple. The gradient helps you to quickly identify winners and losers.

Some uses of volume heatmaps use borders, pop-up text material, or several alerts to reveal volume surges. High volume activity generates much liquidity and often more market attention.

Using their function—Layer 1, DeFi, NFTs, stablecoins, Oracles—tokens are classified by sector or category. This architecture makes it somewhat simpler to spot trends throughout all industries.

Rapid, clear indicators reveal how much of the market Bitcoin or Ethereum dominate, therefore helping you to evaluate the natural inclination of the market.

Who therefore clearly uses bitcoin heatmaps and for what reason?

Active buyers use heatmaps to search for funds with the most energy. They must see where odd extent is growing and want to catch breakouts or prevent abrupt drops.